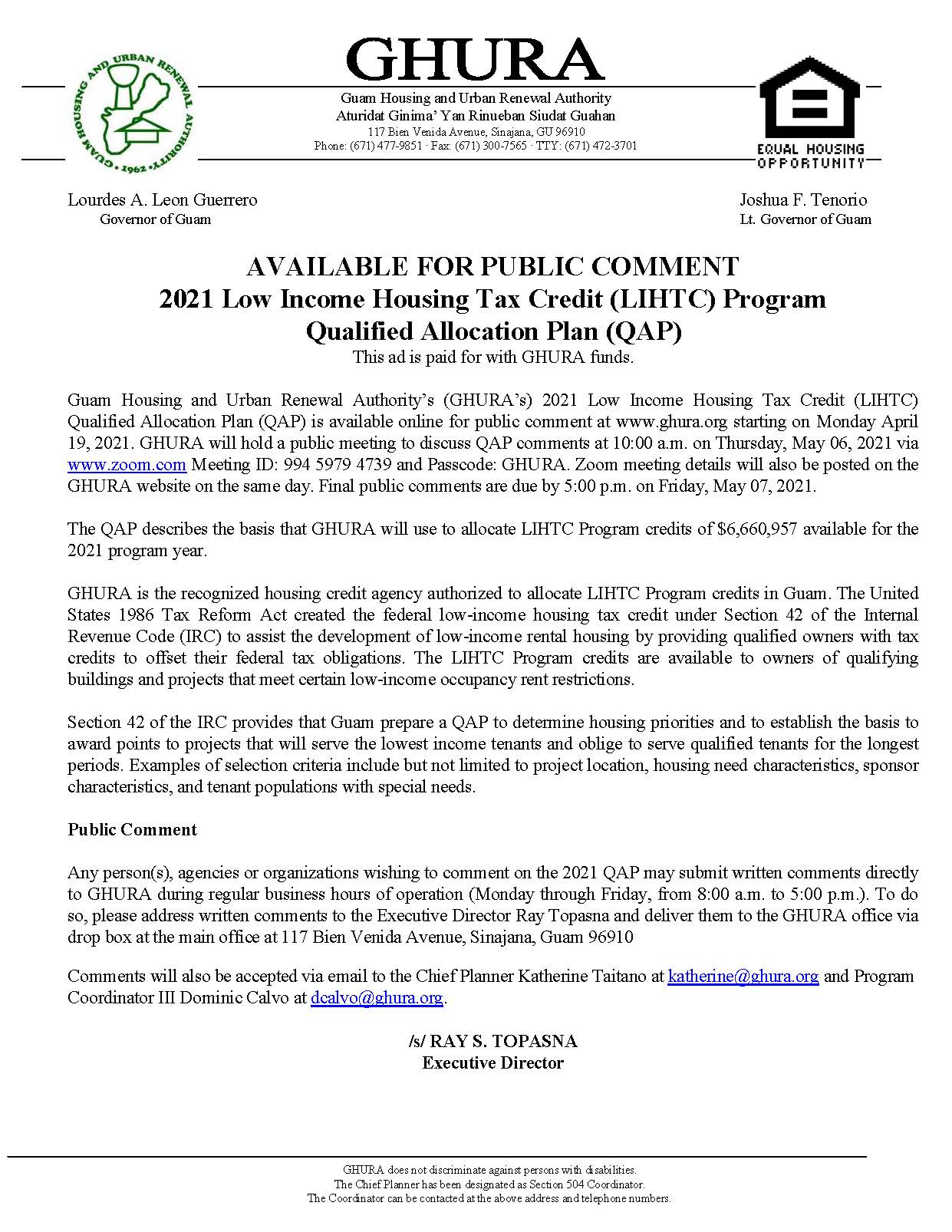

Irs regulation requires that designated state lihtc hfas develop and implement a qualified allocation plan. Web housing project and use the lihtc to reduce their federal tax liability. Web how does the program work? Web for example, in a project with $100,000 in qualified costs, tax credits can equal $40,000 over 10 years. Web according to the new requirement, lihtc project owners seeking access to these fha programs will be required to waive their right to the qualified contract (qc).

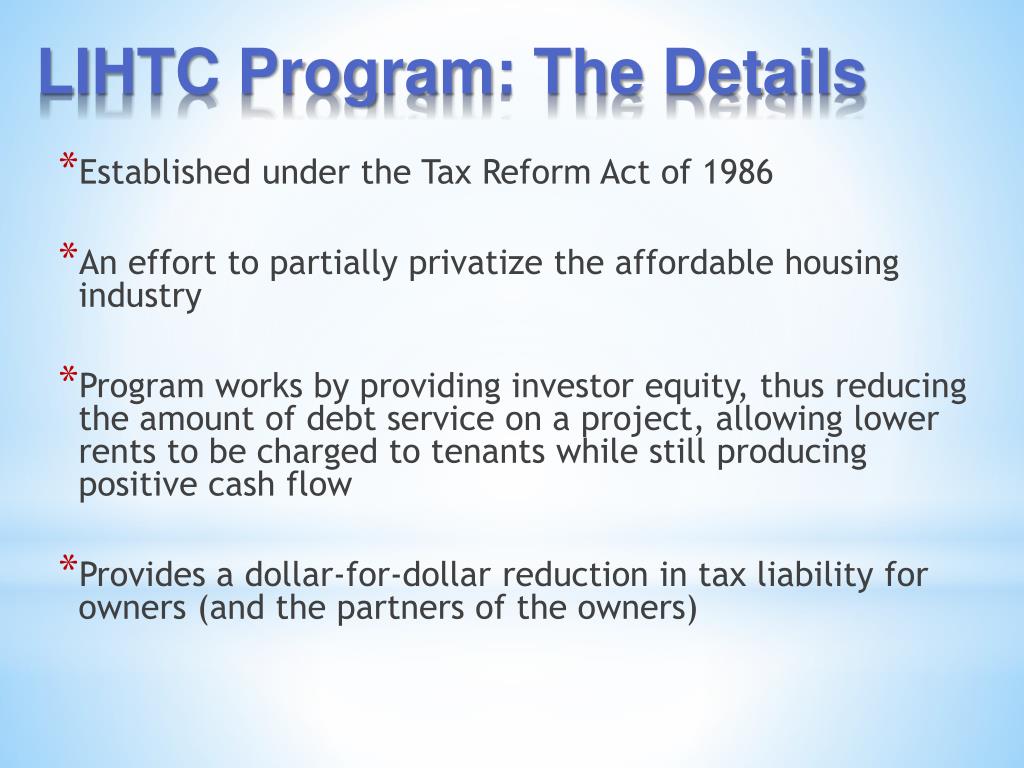

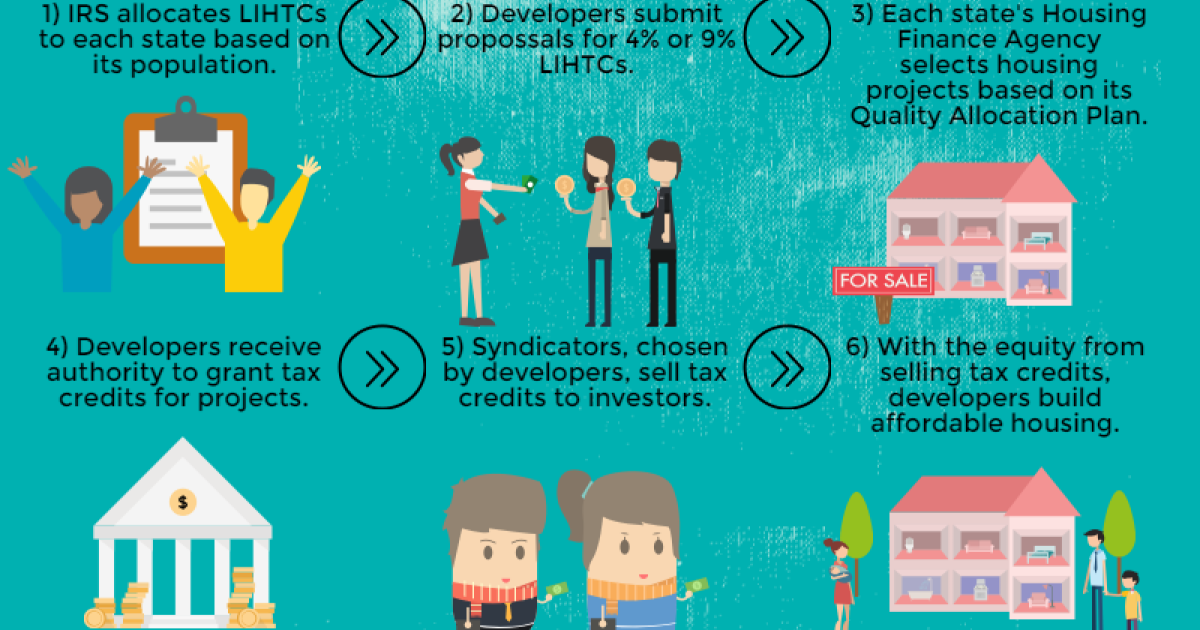

Web housing project and use the lihtc to reduce their federal tax liability. Web how does the program work? Who benefits from the lihtc program? The infusion of equity reduces the amount of money a developer has to borrow and pay interest on, thereby. Web the section 42 low income housing tax credit (lihtc) program is a federal tax incentive that encourages private sector investors, developers and lenders to finance, construct.

Web the section 42 low income housing tax credit (lihtc) program is a federal tax incentive that encourages private sector investors, developers and lenders to finance, construct. Irs regulation requires that designated state lihtc hfas develop and implement a qualified allocation plan. The infusion of equity reduces the amount of money a developer has to borrow and pay interest on, thereby. Web lihtc program are handled on behalf of the irs by the hfas. Web according to the new requirement, lihtc project owners seeking access to these fha programs will be required to waive their right to the qualified contract (qc).

Web the section 42 low income housing tax credit (lihtc) program is a federal tax incentive that encourages private sector investors, developers and lenders to finance, construct. Web housing project and use the lihtc to reduce their federal tax liability. Who benefits from the lihtc program? Web how does the program work? Web according to the new requirement, lihtc project owners seeking access to these fha programs will be required to waive their right to the qualified contract (qc). Web the federal lihtc statute, however, contains a loophole, known as the qualified contract (qc) option, that allows owners to exit the program and all restrictions. Web discover how property owners can navigate lihtc properties affordability limitations through the qualified contract (qc) option outlined in section 42 of the internal revenue code (irc). The lihtc program authorizes state housing credit agencies (hcas) to award 9 percent and 4 percent federal tax credits to developers of affordable. Web chapter 14 low income housing tax credit (lihtc) and other tax credit program guidance. Web for example, in a project with $100,000 in qualified costs, tax credits can equal $40,000 over 10 years. Irs regulation requires that designated state lihtc hfas develop and implement a qualified allocation plan. The infusion of equity reduces the amount of money a developer has to borrow and pay interest on, thereby. Web lihtc program are handled on behalf of the irs by the hfas.

Web Lihtc Program Are Handled On Behalf Of The Irs By The Hfas.

The lihtc program authorizes state housing credit agencies (hcas) to award 9 percent and 4 percent federal tax credits to developers of affordable. Irs regulation requires that designated state lihtc hfas develop and implement a qualified allocation plan. Web how does the program work? Who benefits from the lihtc program?

Web Discover How Property Owners Can Navigate Lihtc Properties Affordability Limitations Through The Qualified Contract (Qc) Option Outlined In Section 42 Of The Internal Revenue Code (Irc).

Web housing project and use the lihtc to reduce their federal tax liability. Web chapter 14 low income housing tax credit (lihtc) and other tax credit program guidance. Web for example, in a project with $100,000 in qualified costs, tax credits can equal $40,000 over 10 years. Web according to the new requirement, lihtc project owners seeking access to these fha programs will be required to waive their right to the qualified contract (qc).

Web The Federal Lihtc Statute, However, Contains A Loophole, Known As The Qualified Contract (Qc) Option, That Allows Owners To Exit The Program And All Restrictions.

The infusion of equity reduces the amount of money a developer has to borrow and pay interest on, thereby. Web the section 42 low income housing tax credit (lihtc) program is a federal tax incentive that encourages private sector investors, developers and lenders to finance, construct.

![[Infographic] The Low Housing Tax Credit Program How does it](https://www.wilsoncenter.org/sites/default/files/styles/embed_text_block/public/media/images/article/lihtc-mechanism-chart.png)