Find out what information you need, how to log in or create an account, and what to do after you register. Mail your completed application to: Web this form is for homeowners who already have a basic star exemption and need to reapply due to a change of ownership. Web homeowners not currently receiving star who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and. You are considered a new star applicant if you:

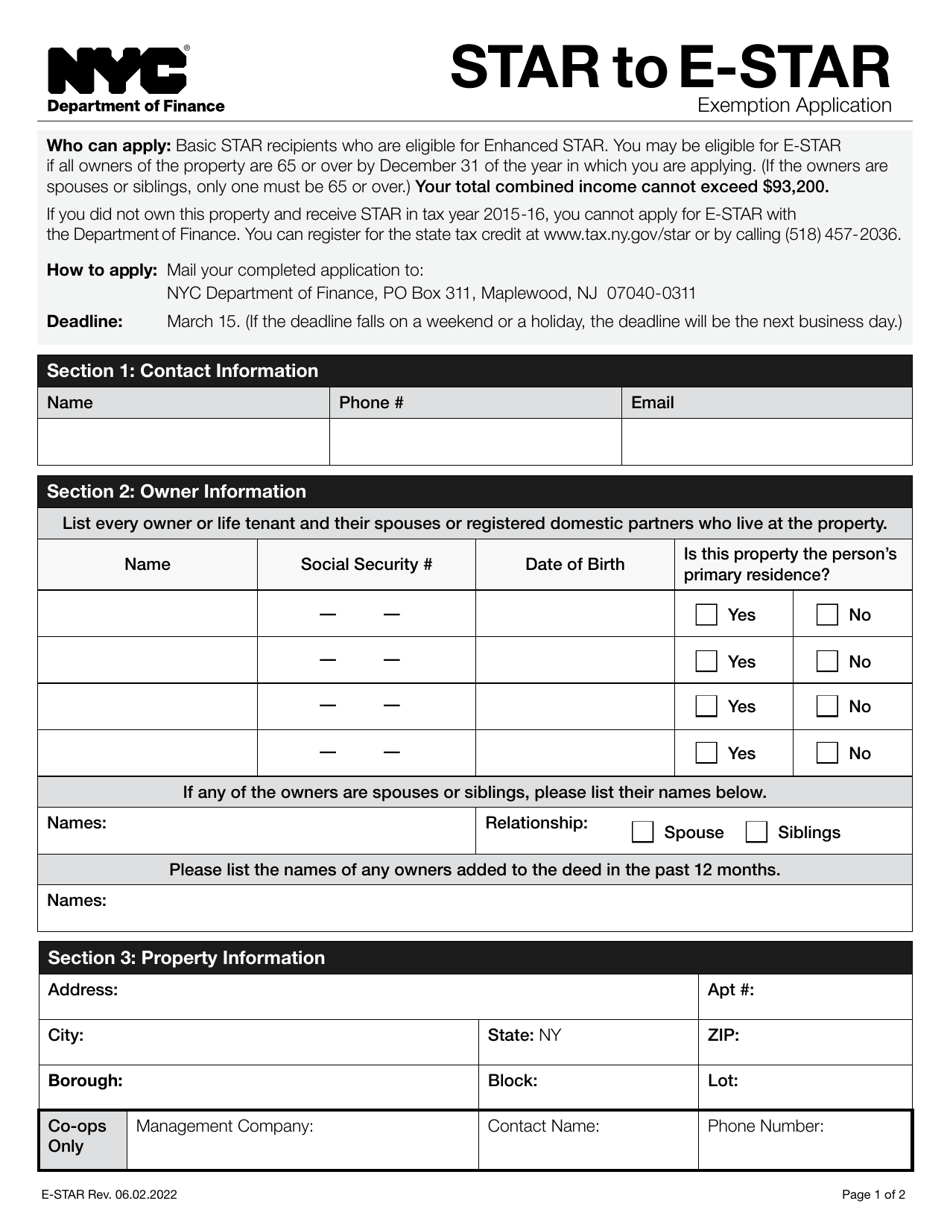

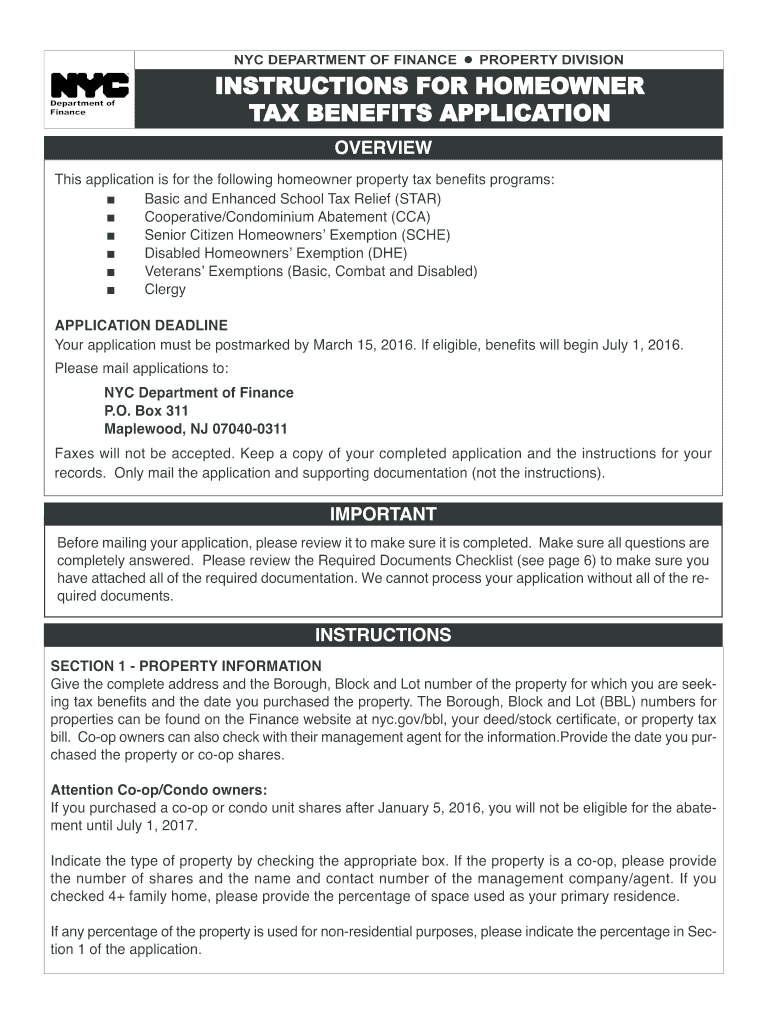

Web this form is for homeowners who already have a basic star exemption and need to reapply due to a change of ownership. Web learn about star benefits for homeowners. All new homeowners must register with ny state in order to receive the star exemption. Web if you are not currently receiving star, but believe you may qualify for the rebate, you can apply online. Web learn how to apply for the enhanced star exemption, which reduces school taxes for eligible homeowners, and how to verify your income eligibility.

Applying online is the easiest way to apply, and if eligible you will receive. Web you must file exemption applications with your local assessor’s office. Web when you register for the star credit, the nys tax department will automatically review your application to determine whether you’re eligible for the basic or enhanced star. Find out what information you need, how to log in or create an account, and what to do after you register. See municipal profiles for your local assessor’s mailing address.

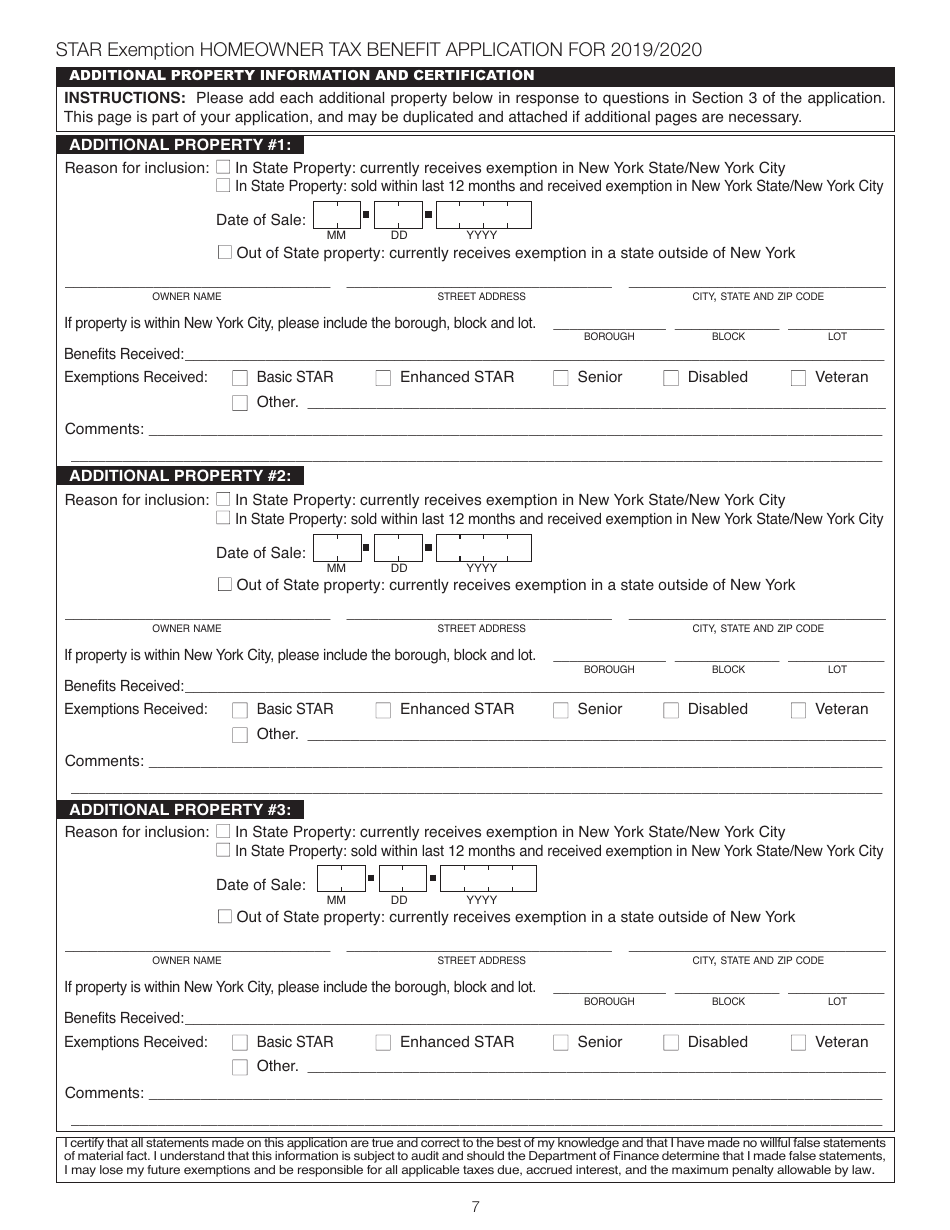

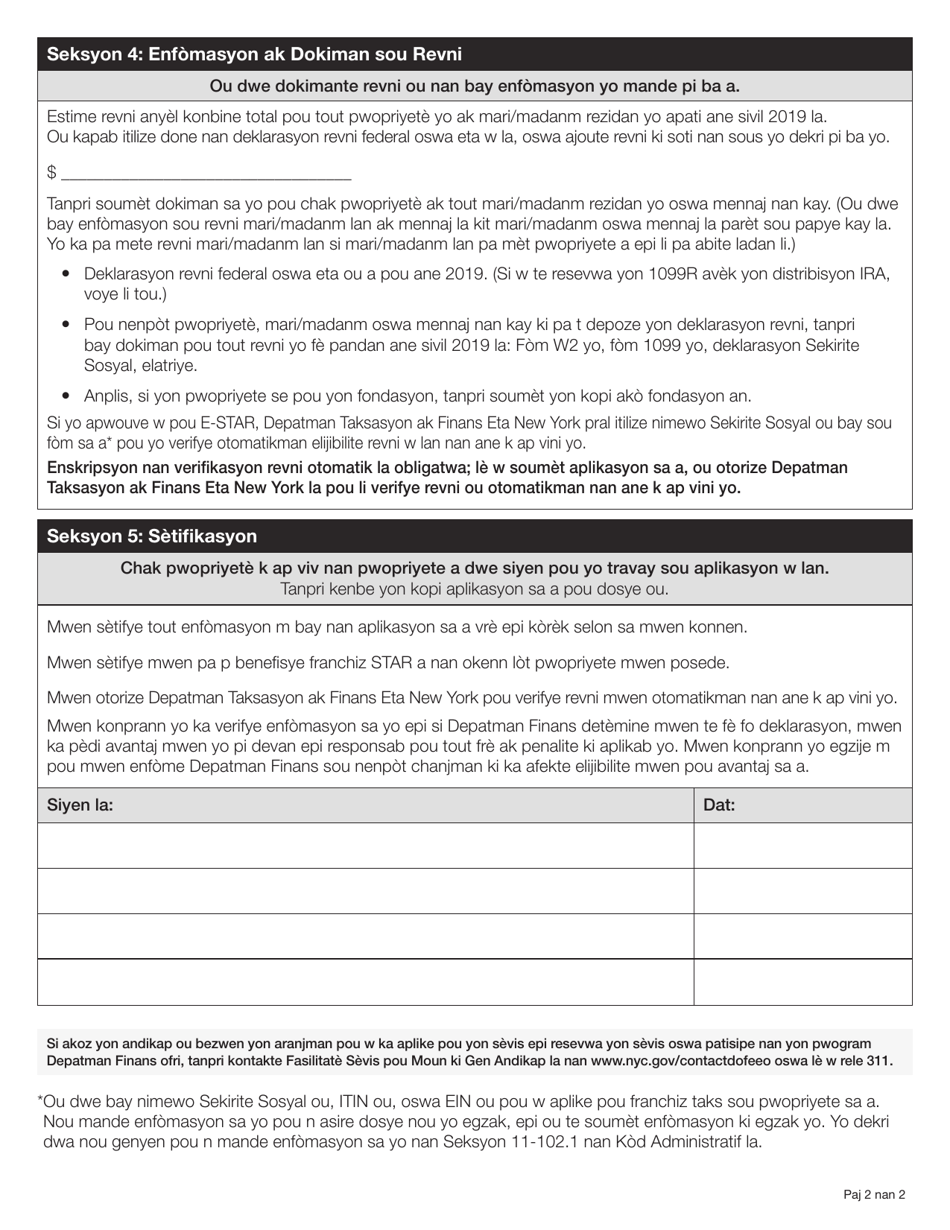

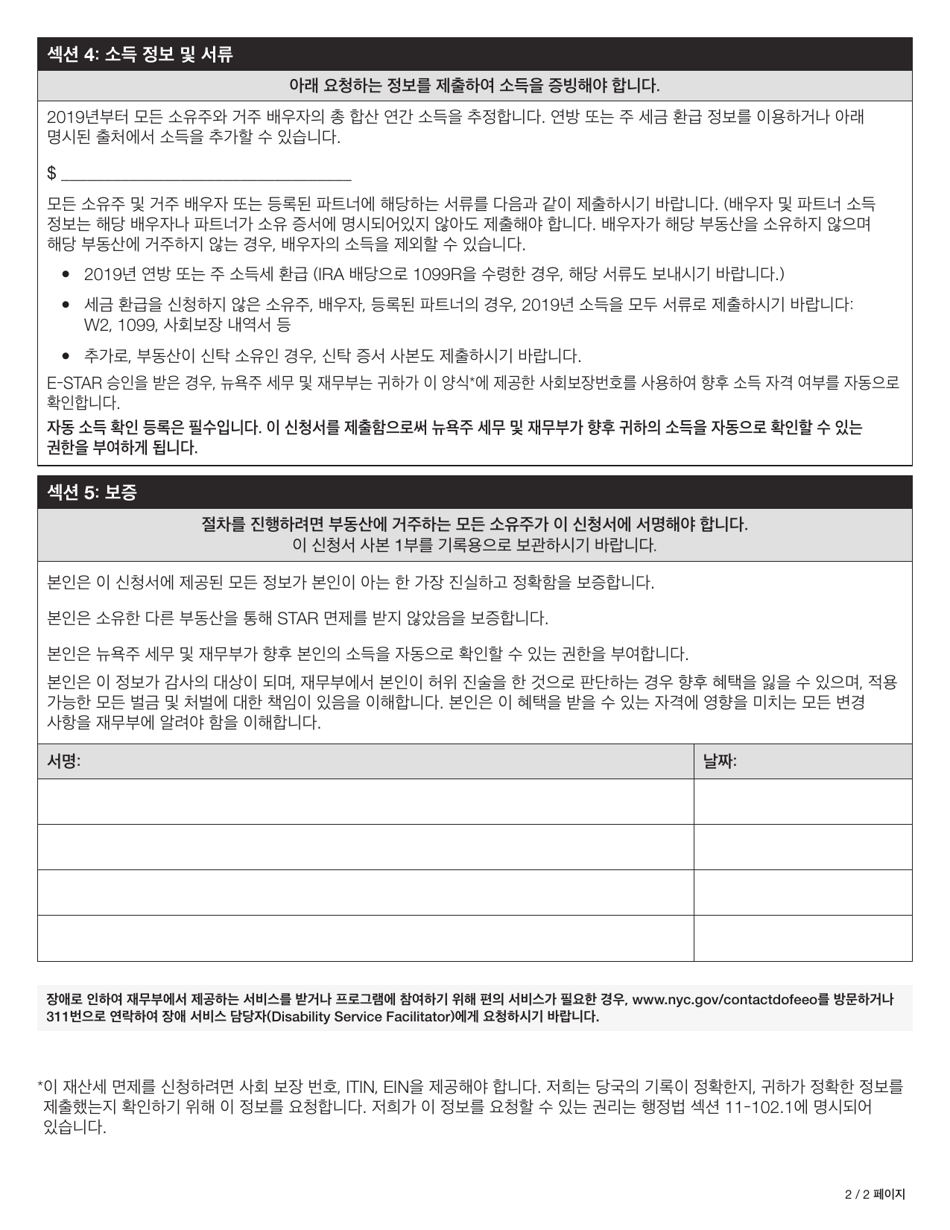

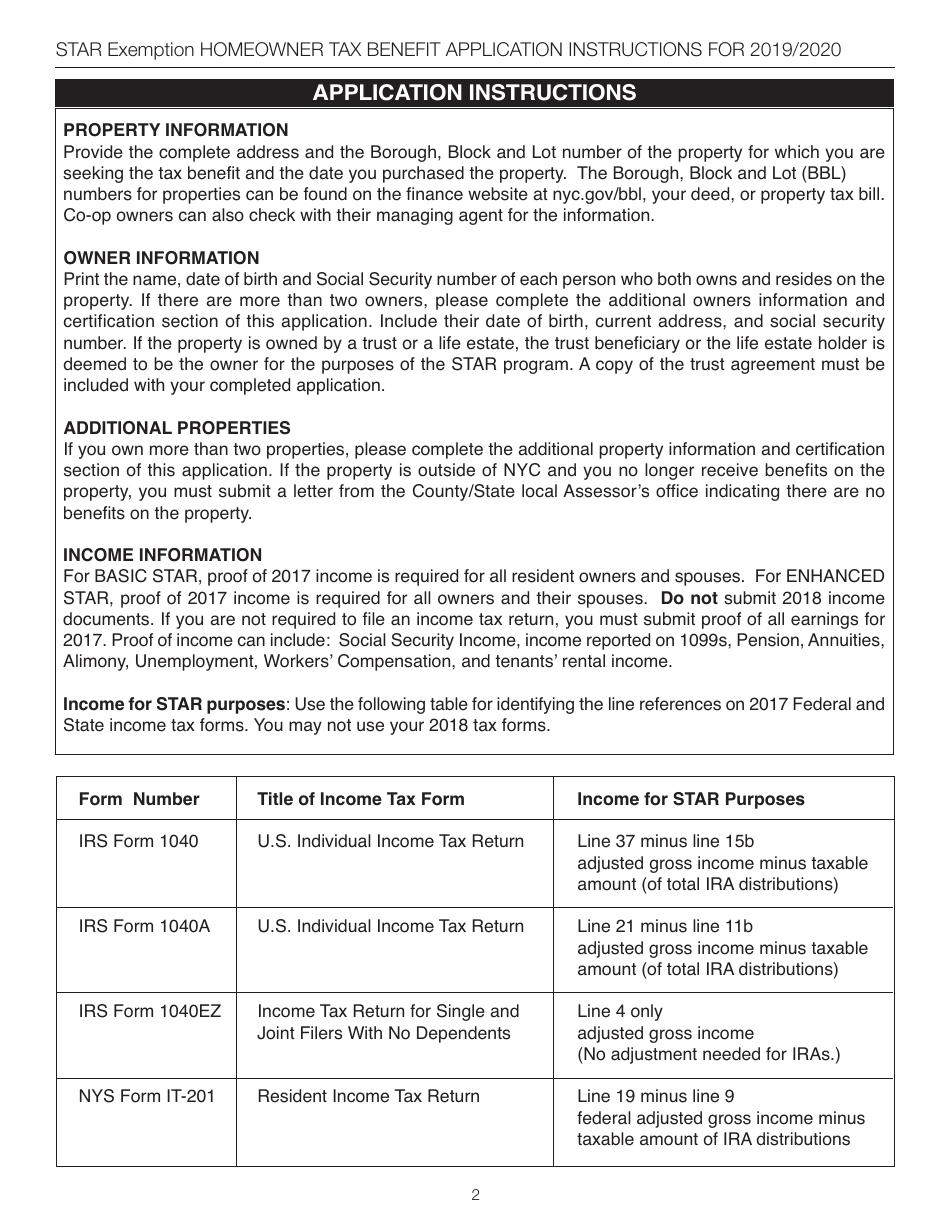

All new homeowners must register with ny state in order to receive the star exemption. Web you must file exemption applications with your local assessor’s office. Web how can i get help? You are considered a new star applicant if you: Do not file any exemption. Traditional method prior to the deadline, provide your assessor with your star application and a copy of your income tax return(s) for the appropriate income tax year. Web star helps lower the property taxes for eligible homeowners who live in new york state. Web learn about star benefits for homeowners. Web current star exemption recipients. Mail your completed application to: Web new star applicants must apply for the benefit with the state. Web how to apply for the star credit. If you have an existing star exemption, you may need to reapply with your assessor for one of the following reasons:. Web as a new york state homeowner, you can now view and update your property tax benefit registrations and enroll in direct deposit for your star credit. Didn't own your property on march 15, 2015, or.

Web As A New York State Homeowner, You Can Now View And Update Your Property Tax Benefit Registrations And Enroll In Direct Deposit For Your Star Credit.

See municipal profiles for your local assessor’s mailing address. Find out what information you need, how to log in or create an account, and what to do after you register. Web homeowners not currently receiving star who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and. Web learn about star benefits for homeowners.

Learn How To Register For The Basic Or Enhanced Star Credit, A Property Tax Benefit For Homeowners In New York State.

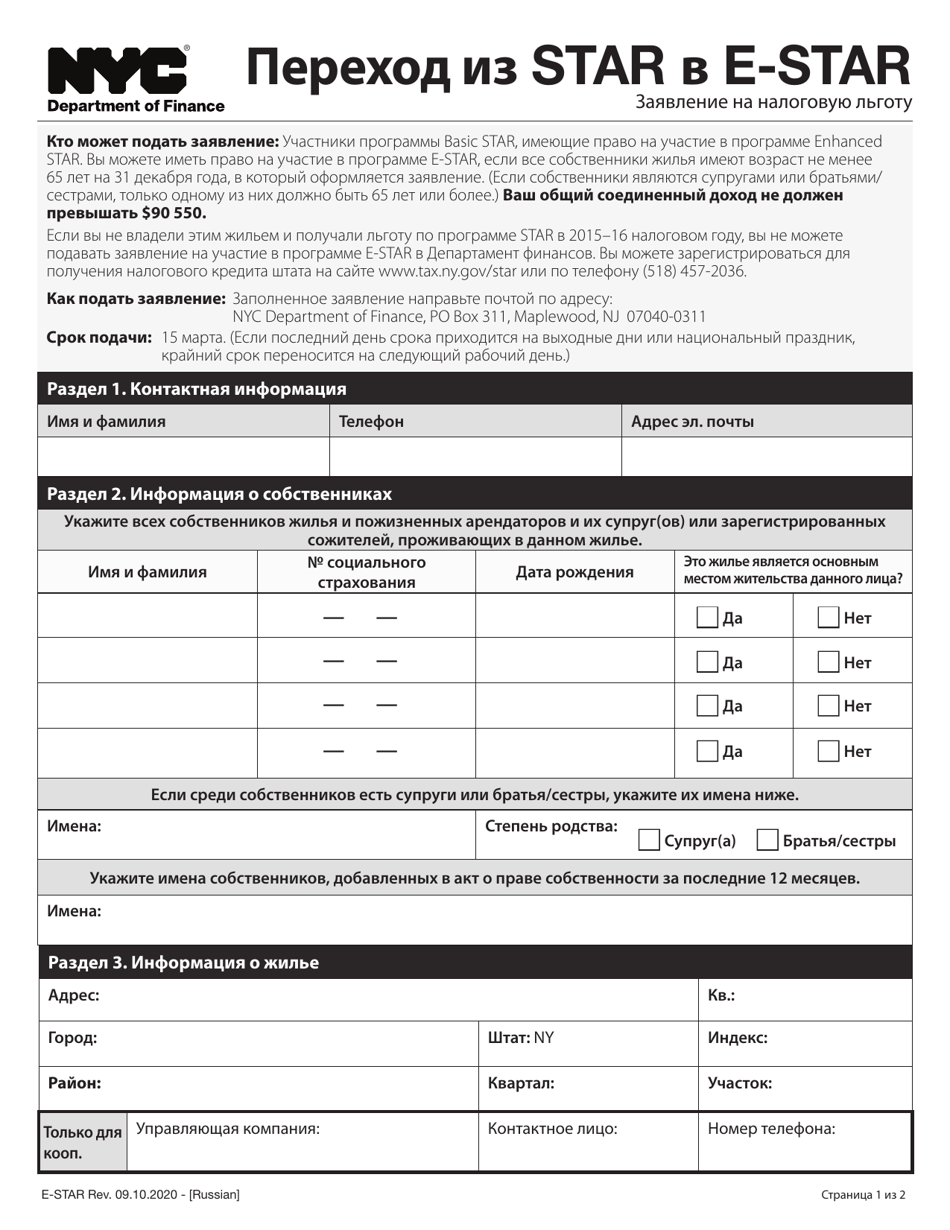

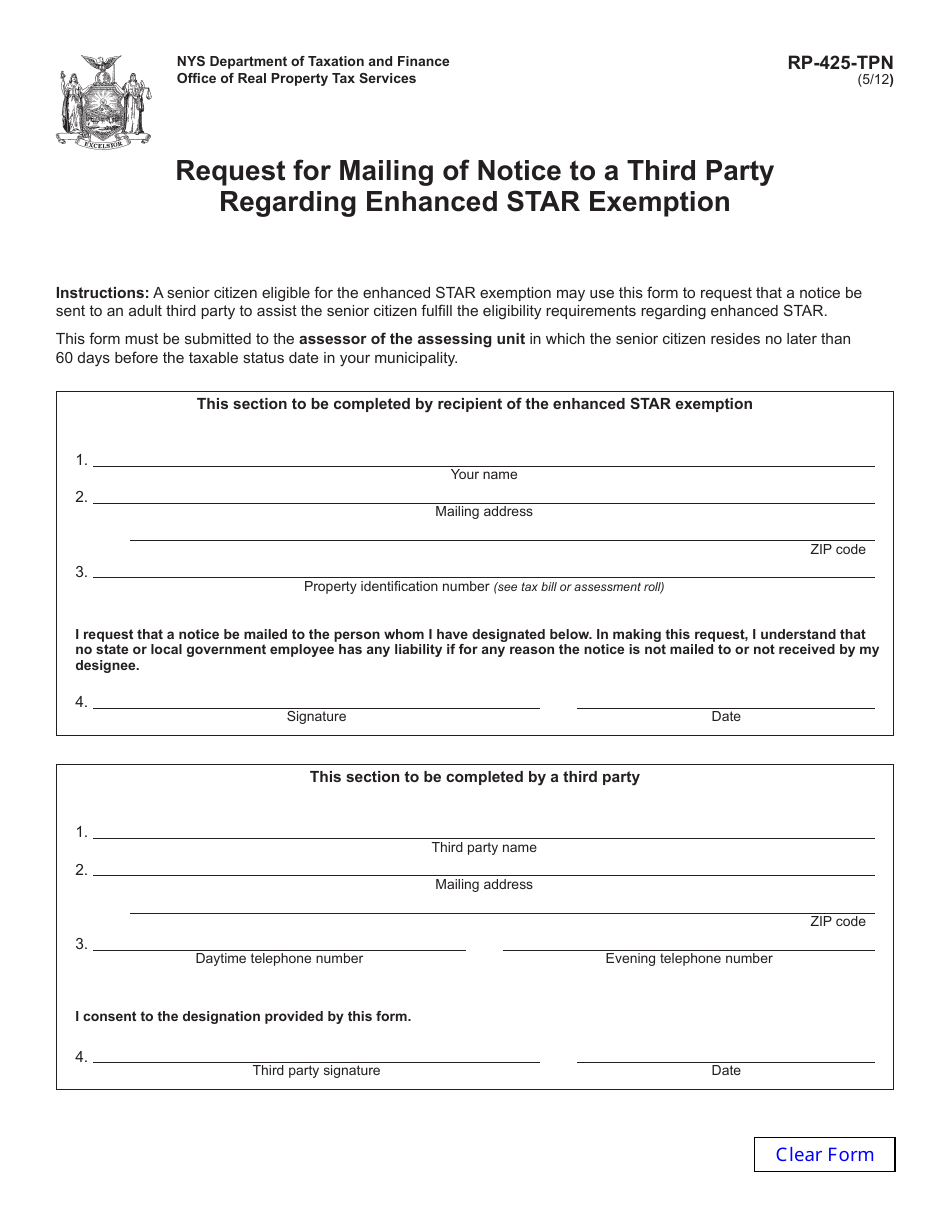

Web learn how to apply for the enhanced star exemption, which reduces school taxes for eligible homeowners, and how to verify your income eligibility. Web when you register for the star credit, the nys tax department will automatically review your application to determine whether you’re eligible for the basic or enhanced star. Web if you are not currently receiving star, but believe you may qualify for the rebate, you can apply online. Web how to apply for the star credit.

Web How Can I Get Help?

You are considered a new star applicant if you: Web you must file exemption applications with your local assessor’s office. Learn how to apply online, by mail, or by phone for the basic or. Web current star exemption recipients.

If, For Tax Year 2023, You Received At Least $100 For The Empire State Child Credit And Filed Your New York State.

Web star helps lower the property taxes for eligible homeowners who live in new york state. Do not file any exemption. If due to a disability you need an accommodation in order to apply for and receive a service, or to participate in a program offered by the department of. It requires proof of income and primary.